Is now a good time to buy?

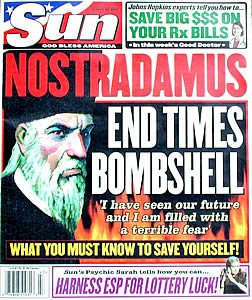

I have been telling everyone the best thing that could happen to the real estate market in Canada right now would be for our cable companies to stop carrying CNN. We need a break from the panic mode doom and gloom financial health forecasts of economic prophets lined up around the block at CNN headquarters like it was the tryouts for American Nostradamus. My suggestion, watch a good movie. Back to you Wolfe.

Interest rates keep falling and are still at historical lows right now however lenders have begun tightened the purse strings on higher risk borrowers this year. If your credit is good and the property appraises at or within your purchase price then you should not have problems securing a mortgage.

We are still in a general period of stifled growth economically and likely will remain in that shadow for a while yet due to global economic tension. This climate has caused many to hesitate on buying real estate and allowed listing inventory to accumulate this year to previously unseen levels. This presents opportunity for smart investors and savvy home buyers. Right now there are record numbers of properties listed for sale in and around Barrie.

Many of those sellers have been listed longer than they hoped to be and are looking to negotiate. Some will have found the home they want to buy and made offers conditional on their own sale. The clock on their conditional offer is counting down. This happens more frequently in a slow turnover market. Some are finding they are in deeper than they can or want to handle financially with increased energy costs and wish to downsize or cash out of the market altogether for a while. The problem for those in that situation today is it can take a few more months than they are prepared for to close a sale and this puts pressure on them to take the offer presented to them now over chancing the odds of a better offer down the road.

My advice would be turn off the TV and start watching the real estate papers for some of the deals that are out there.